Innovative Eco-Financial Services - New Type of Digital Trading in Agricultural Commodities

創新生態金融服務

Bank Sinopac

INTRODUCTION

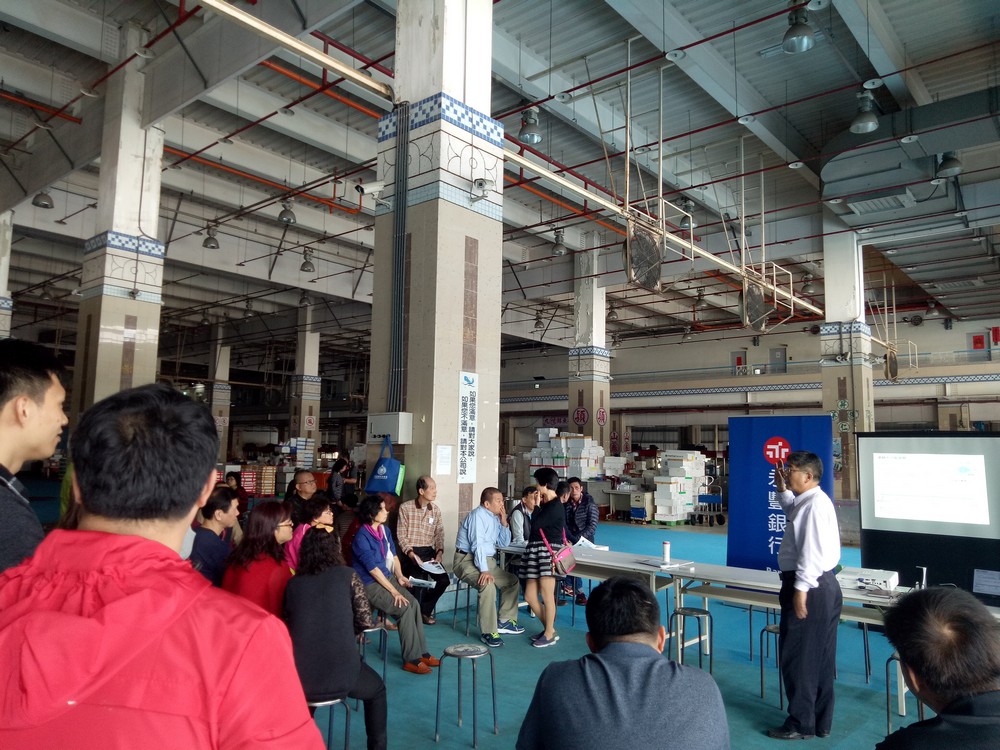

In 2015, Bank SinoPac entered the wholesale market and realised that traditional cash collections and payments were extremely time consuming, which was also risky to be carried around. It is not easy for merchants to obtain bank credit lines because they do not have complete financial statements, and the environment often leads to vegetable debris and meat scraps on banknotes, which causes difficulties for the merchants to make deposit over the counter. After in-depth research on market operations, the Company has adopted the Internet, Internet of Things, and Big Data, along with physical sites and cloud technology, to introduce new digital transactions of agricultural products.FRAMEWORK AND STRATEGY

Three key points of Smart Wholesale Market Transaction Facilitation Platform is to provide payment financing for merchants, such as advance payment made by the Company to reduce the cost of collection for the market. Followed by the integration of virtual and physical services. The merchant’s card has integrated services, including financial, access control, and statement printing; and automatic teller machine (ATM) has been used to replace manual payment collection. Lastly, smart collection of fees whereby payments are deducted from accounts, making it easier for reconciliation. With this three key points, customers’ needs are at the core of the Company; thus, during the beginning of the cooperation, the Company sent employees’ to introduce modern financial services in the most traditional field.ACHIEVEMENT AND IMPACT

The implementation of inclusive financing is to educate merchants who were not familiar with the operation of the ATM, currently 15,000 transactions were conducted in a month. There was an increase amount of transaction, a market with which the Company has cooperated and grew by 15% in the first year, 29% in the second year and 43% in the third year. Also, the Company established their reputation to provide convenient financial services and have gained a reputation and many wholesale markets have expressed their willingness to cooperate. Lastly, the transformation of retail payment was developed for the downstream market in an in-depth manner to promote payment by scanning codes in retail market.FUTURE DIRECTION

There are two directions for Eco-Financial Services promotion in the future. The mid-term plan is to expand the financial services to upstream suppliers, to plan the launch of Agroecology Promotion Credit Card to provide advanced payments for various expenses in the food and agricultural ecosystem, while planning an instalment plan to reduce the pressure on repayment. However the long-term plan is to promote cloud transactions of agricultural products by developing API connection and a function of real-time payment inquiry for merchants, to build the Smart Wholesale Market Transaction Facilitation Platform 2.0, to respond to the trend of transaction transformation through information upgrade.

Bank SinoPac, domiciled in Taiwan, is a wholly-owned subsidiary of

SinoPac Holdings. In addition to Taiwan, it has branch network in Hong

Kong, Macau, Los Angeles and Ho Chi Minh City. It also has presence

in China through wholly-owned subsidiary -Bank SinoPac (China).